Supporting Projects that Advance the Business Ecosystem

Central Virginia has a robust, collaborative, and rapidly growing business ecosystem in our beautiful Blue Ridge Mountain location.

Our ecosystem participants include:

- Startup Entrepreneurs

- Seasoned, Successful Entrepreneurs

- Mature ‘Prime’ Businesses

- Entrepreneur Service Providers – ESOs

- Professional Service Providers (lawyers, accountants, etc.)

- Funders (CDFIs, banks, angel and venture capital)

- Mentors

- Economic Development Professionals

- Colleges and Universities

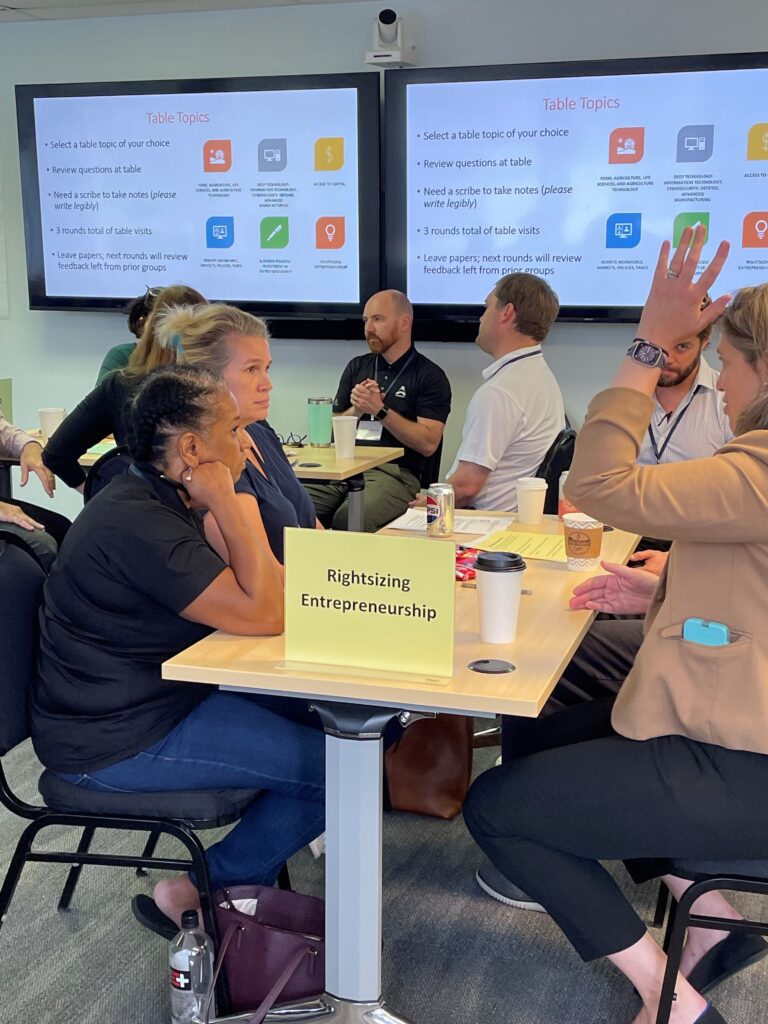

Proven models for successful ecosystems emphasize communication and access. Venture Central convenes-connects-supports for optimization, efficiency, and award.

Collaborative Projects Managed by VCVA

Diversify-Connect-Fund

U.S. Economic Development Administration Project

Regional Entrepreneurship Initiative

GO Virginia Region 9 Study, Plan, & Implementation

NextCrave

Food & Beverage Business Accelerator Study

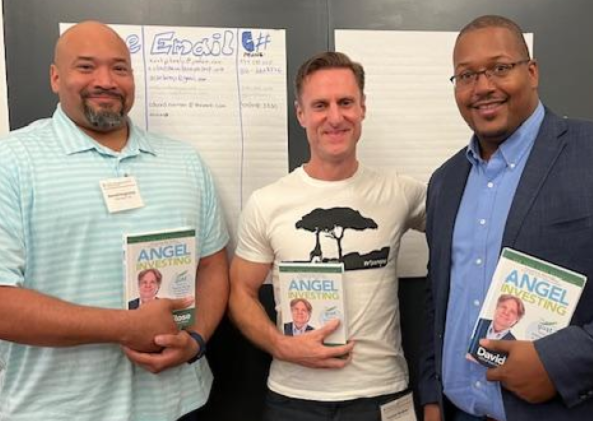

Diversifying Risk Capital

U.S. Small Business Administration – application